Net income recognition always increases – Net income recognition, the cornerstone of accounting practices, has always been on an upward trajectory. This phenomenon, imbued with far-reaching implications, warrants a thorough examination to unravel its intricacies and discern its impact on financial reporting and business decision-making.

The concept of net income recognition revolves around the timing of revenue recognition, which profoundly influences the reported net income. Various income recognition methods exist, each with its own nuances and applications. Understanding these methods and their impact on net income is crucial for stakeholders seeking accurate and reliable financial information.

Income Recognition Methods

Income recognition is the process of recording revenue in the financial statements. There are two main methods of income recognition: the accrual method and the cash basis method.

Under the accrual method, revenue is recognized when it is earned, regardless of when cash is received. This method is used by most businesses because it provides a more accurate picture of the company’s financial performance.

Under the cash basis method, revenue is recognized only when cash is received. This method is simpler to use, but it can lead to a distorted view of the company’s financial performance.

Examples of Income Recognition Methods, Net income recognition always increases

- Accrual method:A company sells a product on credit. The revenue is recognized when the product is shipped, even though the cash has not yet been received.

- Cash basis method:A company provides a service and bills the customer. The revenue is recognized when the customer pays the bill.

Impact of Income Recognition on Net Income: Net Income Recognition Always Increases

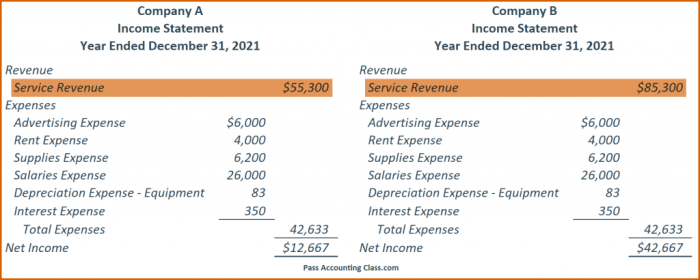

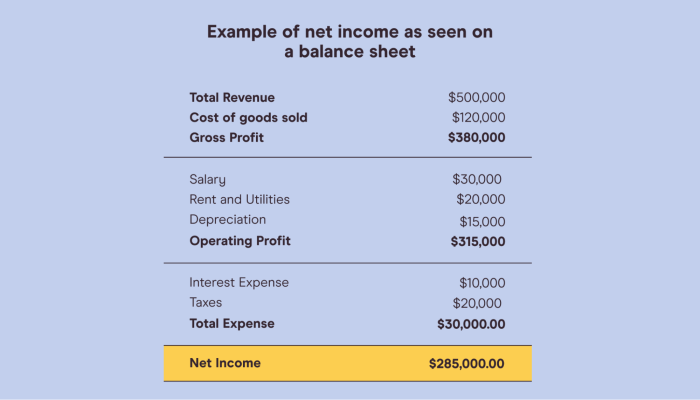

The timing of revenue recognition has a significant impact on net income. If revenue is recognized early, it will increase net income in the current period. If revenue is recognized late, it will decrease net income in the current period.

For example, if a company uses the accrual method to recognize revenue, it will recognize revenue from a sale even if the cash has not yet been received. This will increase net income in the current period.

If a company uses the cash basis method to recognize revenue, it will not recognize revenue from a sale until the cash has been received. This will decrease net income in the current period.

Factors Affecting Income Recognition

The choice of income recognition method is influenced by a number of factors, including:

- The nature of the business:Some businesses, such as manufacturing companies, have a more predictable revenue stream than others, such as service companies.

- The accounting standards:The accounting standards in a particular country or jurisdiction may dictate the use of a particular income recognition method.

- The company’s financial position:A company’s financial position may influence its choice of income recognition method. For example, a company that is struggling financially may be more likely to use the cash basis method to recognize revenue.

Ethical Considerations in Income Recognition

Income recognition is an area where there is a potential for income manipulation. This can occur when a company intentionally uses an income recognition method that results in a more favorable financial picture.

Income manipulation can have a number of negative consequences, including:

- Misleading financial statements:Income manipulation can lead to financial statements that do not accurately reflect the company’s financial performance.

- Loss of investor confidence:Investors may lose confidence in a company if they believe that its financial statements are not accurate.

- Legal liability:Income manipulation can lead to legal liability for the company and its management.

International Differences in Income Recognition

There are a number of differences in income recognition practices across different countries. These differences are due to a variety of factors, including:

- The accounting standards:The accounting standards in a particular country or jurisdiction may dictate the use of a particular income recognition method.

- The tax laws:The tax laws in a particular country may influence the choice of income recognition method.

- The business culture:The business culture in a particular country may influence the choice of income recognition method.

Emerging Trends in Income Recognition

There are a number of emerging trends in income recognition practices. These trends include:

- The increasing use of the accrual method:The accrual method is becoming more popular because it provides a more accurate picture of the company’s financial performance.

- The development of new accounting standards:The accounting standards in a particular country or jurisdiction may change over time, which can impact the choice of income recognition method.

- The increasing use of technology:Technology is making it easier for companies to track and record revenue, which can impact the choice of income recognition method.

FAQ Explained

What are the key factors that influence income recognition methods?

The choice of income recognition method is influenced by factors such as the nature of the transaction, the industry in which the company operates, and the applicable accounting standards.

How can income recognition be manipulated?

Income recognition can be manipulated through aggressive revenue recognition practices, such as recognizing revenue prematurely or deferring expenses. Such practices can distort financial statements and mislead stakeholders.

What are the ethical implications of income recognition?

Income recognition has significant ethical implications, as it can impact the distribution of profits among stakeholders, affect tax liabilities, and influence investment decisions. Ethical considerations require transparent and accurate income recognition practices.